Unfazed by banks’ lukewarm response, RBI may stick to VRRR auction

This was the third back-to-back auction aimed at sucking out liquidity in the banking system

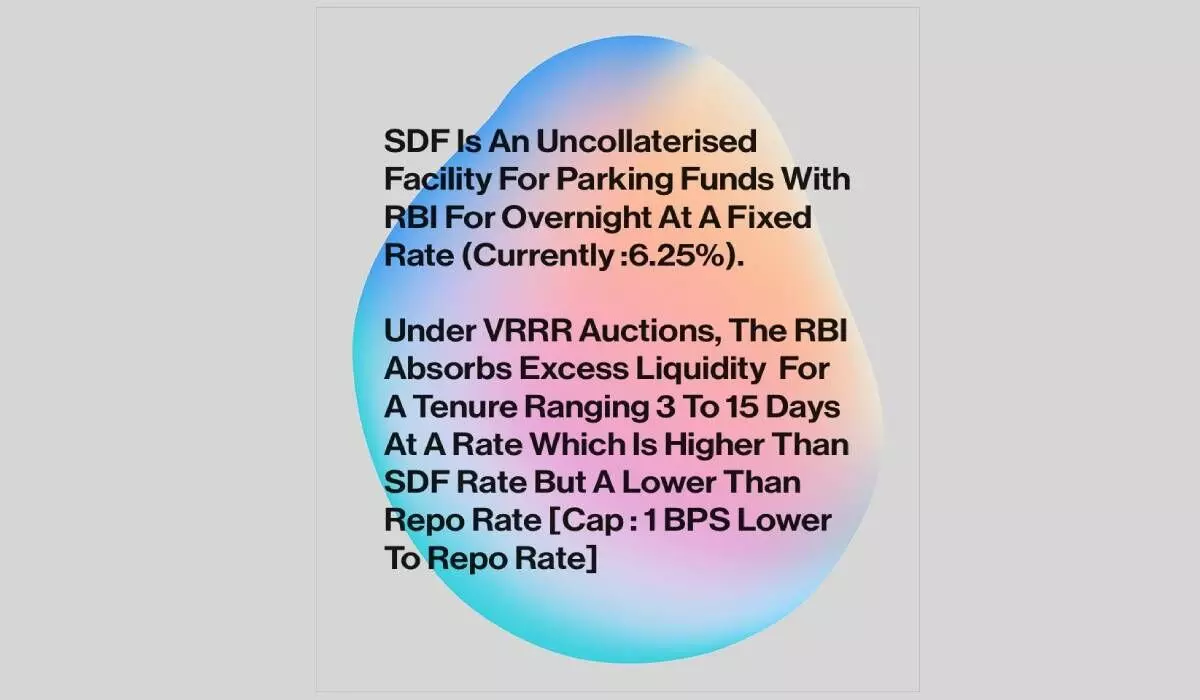

image for illustrative purpose

Even as Reserve Bank of India (RBI) goes for variable rate reverse repo (VRRR) auction in its bid to reduce surplus liquidity in the banking system, mainly caused by the return of Rs 2000 banknote, banks are wary of participating due to advance tax and GST filing. Still. RBI is likely to continue with the option for the next few weeks.

The central bank conducted a three-day VRRR auction, which is usually undertaken to withdraw excess liquidity from the banking system, for Rs 75,000 crore last week.

But, banks showed a tepid response, deployed funds much lower than the notified amount in the last four VRRR auctions. They deployed funds merely at Rs 1,51,733 crore, against a cumulative notified amount of Rs 4.50 lakh crore in all the four VRRR auctions so far.

Of course, this was the third back-to-back auction in the apex bank’s bid to suck out liquidity in the banking system, which was estimated to be in surplus of Rs 2.26 lakh crore, more due to the coming back of Rs 2000 banknotes to the bank branches.

The central bank conducted the VRRR auction for a notified amount of Rs one lakh crore on June 5.

In the backdrop of the action was the news that banks had parked only Rs 508.68 billion with the RBI under a 14-day VRRR. Now, it has to be seen if it was able to help check inflation, currently hovering around five per cent.

On their part, banks are wary of participating in the longer tenor VRRR auction amid fears that scheduled tax outflows over the next two weeks could reduce surplus liquidity and cause temporary mismatches in their books. India's banking system liquidity surplus stays close to

2.4 trillion rupees, which is the highest in the last two months, and is keeping overnight rates low.

Talking to Bizz Buzz, Madan Sabnavis, Chief Economist, Bank of Baroda, says, “V3R will continue as long as there is surplus liquidity in the system, which is presently above Rs two lakh crore. The response was tepid as banks are keen to know what the RBI has to say in its policy. Otherwise, the response would have been better.”

V3R will continue for the next few weeks. The tenure is important as banks may not want to lock in funds for longer tenures. Ideally, two to four days tend to work better, he added.

Not to mention, V3R will remain in the banking system for as long as there is surplus liquidity in the system, which is presently due to the coming back of Rs 2000 banknotes into the system. Sometime back, the RBI governor had said that Rs 1,80,000 crore has already come back to the bank in the form of deposit of Rs 2000 banknotes.

“VRRR auction is a monetary policy tool being employed by our central bank to optimise liquidity in the banking system. Given the uncertainty in the global economy and inflation expectations from El Nino in India, VRRR irons out the skewed liquidity distribution among individual banks and the temporary liquidity resulting from Rs 2,000 banknotes,” opines Dr. Nirakar Pradhan, CEO of PRMIA India.

More arrival of Rs 2K banknote will mean strengthening deposit base of the bank, which may help them meet the forthcoming increased credit

demand due to the festive season. It assumes significance at a time when the government has said ‘no-no’ against the capital infusion to the

state-run lenders.

Anil Kumar Bhansali, head of treasury, Finrex, says, “With the withdrawal of Rs 2000 notes from the system, these will come as a deposit into the banks.”

The amount expected in the form of deposit as per various estimates is Rs 2.5 lakh crore. The RBI is still in tightening mode and would like to keep inflation down and therefore may continue with accommodative stance in the next policy review meeting, due in August, before it changes its tack towards rate cut in next calendar year onwards. V3R was just one among several tools for the same. In contrast, rate cut was a one-time off action.

As regards bond market and treasury bills, they are presently in a comfortable position. While 10-year G-Sec yield was currently hovering at seven per cent, T-Bills are giving 6.60 to seven per cent.